In recent decades the world has gradually understood the importance of transitioning to a clean energy economy, buoyed by the prospective of catastrophic environmental collapse. However, few know that this transition largely rests on the employment of a few critical minerals whose global demand is set to skyrocket in the near future. Of particular importance in this case are the so called “rare earth” minerals, which have been at the center of US-China tensions on trade and technology in the recent decade. This article will give a brief account of the current situation regarding the rare earth elements supply chain and how it has been at the center of US-China competition.

According to the Science History Institute, rare earth elements (or REE) are 17 metallic elements with unusual fluorescent, conductive and magnetic properties which make them important components of many technological devices, including smartphones, LED lights, and hybrid cars.

Some are used in oil refinement and nuclear power or have specialized uses in medicine and manufacturing, while others are important for wind turbines and electric vehicles.

Hence it is clear that rare earths will play a fundamental role in the transition to a cleaner energy economy, being part of a limited number of critical metals whose demand is set to skyrocket by 400-600 percent over the next several decades, according to the latest White House briefing on the subject dated February 22, 2022.

It’s important to underline that China has been for decades the main “miner” and exporter of REE, and as of 2022, as reported by China Briefing, various estimates indicate that China is responsible for 55 to 70 percent of rare earth mining and up to 90 percent of processing.

The fear of China reducing rare earth elements exports in the context of the recent trade war has convinced the US to re-establish a national supply chain for the production and the processing of rare earth elements, a sector which had been almost completely abandoned in the latest decades.

Early on, REE mining and processing were technologies developed and nearly monopolized by the United States, indeed the Mountain Pass mine, situated in the Mojave Desert of California, was the only major source of rare earths in the world in the years between the 1950s and 1990s.

However, by the beginning of the 2000s the mine was inactive, since the US administrations and major manufacturers of the time thought it more advantageous and cheaper to import the REE supply from China to avoid the extraction costs and environmental regulations.

Indeed, rare earths elements, despite being actually quite abundant, are usually found in very small deposits, mixed with other materials, while most of their applications require a 99,9 percent level of purity making their extraction and processing difficult and damaging to the environment.

Something which made the prospect of delegating these operations to other nations quite attractive.

These factors allowed China to quickly gain dominance in the sector. Indeed, as mentioned in a 2021 ISPI report, 80 percent of REE imports to the USA and 98 percent of imports to the EU come from China.

As mentioned before, the prospect of China blocking or putting sanctions on the export of REE in the context of the recent trade war (something which China threatened to do in 2019 and already did in 2010 with Japan, during a maritime dispute), has completely reversed US policy in the sector, with both the Trump and Biden administrations striving for the re-establishment of a local supply chain.

To address this issue, US administrations have moved to massively fund MP Materials, the company which bought the mine in Mountain Pass, California in 2017, while coming to an agreement, in 2019, with the Australian mining company Lynas Rare Earths Ltd. to build a rare earth processing facility in Texas.

The Biden administration, building on an executive order by Trump in 2017, promulgated Executive Order 14017 America Supply Chain which, according to the White House statement of January 2022, had various effects, including:

– Awarding $35 millions to MP Materials to separate and process heavy rare earth elements in Mountain Pass in order to establish a full end-to-end domestic permanent supply chain. This is accompanied by the promise by MP Materials to invest other $700 million in its development by 2024.

– The investment of $140 million, announced by the Department of Defense, into a project “to recover rare earths elements and critical minerals from coal ash and other mine waste, reducing the need for new mining”.

– The announcement of a “long term supply agreement” reached between MP Materials and General Motors.

Besides these provisions, a new bipartisan bill, known as the Restoring Essential Energy and Security Holdings Onshore for Rare Earths Act of 2022 and introduced to Congress in January 2022, proposes to block Defense firms from buying rare earths from China by 2026, using the Pentagon to create a permanent stockpile of the materials.

As reported in Al Jazeera, this would be obtained in part by using the Pentagon’s purchase of billions of dollars’ worth of fighter jets, missiles and other weapons in order to pressure contractors to stop relying on China and strengthen their support toward the development of a local supply chain.

On the international level, the US is focusing its attention on the abundant rare-earth reserves in Africa, entering into negotiations in 2019 with Malawi and Burundi to try to ensure an REE supply line from the African continent.

While the US was focused on these efforts, China didn’t stay idle and made significant moves to consolidate its position, both on the local and international field.

One of the main and most notable actions recently undertaken by the Chinese government to enhance its REE production and exportation was the creation of the China Rare-Earths Group in 2021, a real global giant formed through the merging of the main rare earth mining companies owned by the government with the aim “to better allocate resources, realize green development and update deep-processing of the rare-earth sector”, as reported by Bloomberg.

Conversely China has put great efforts into tapping into the rare earth reserves of other countries, particularly in North and Western Africa, through billions of dollars funneled into the Belt and Road initiative, but also investing in mining operations in Latin America (particularly in Brazil) and Mongolia, as reported by Ariel Cohen in Forbes.

However, China and the US are not the only competitors in the race for REE self-sufficiency. Indeed, as reported by ISPI in 2021 and in the aforementioned article by Forbes in 2022, the European Union, Japan, Australia, and Russia are also looking to increase their presence in Africa, in the EU’s case to reduce their dependence on Chinese imports, and in the case of others to expand their production capacities by striking favorable mining deals.

Due to the large presence of minable REE deposits and the limited capability of local countries to establish supply chains without external investment, Africa will probably become one of the main stages of international REE competition.

REE competition might also be one of the factors behind the 8 year-long civil war and recent Russian invasion of Ukraine, since the Donbass region is an important exporter of Lithium.

The war risks also to significantly curb efforts made by various countries to elude the Chinese monopoly in the sector, since both Russia and Ukraine contribute an important share to the REE global market and the conflict will likely result in manufacturing constraints, supply shortages, and major prices hikes.

The race toward technological self-sufficiency, revolving around rare earths and semiconductor supply chains, is likely to become more and more prominent in the future and a cause for further international tensions and instability. In this context it is interesting to see how the US and China possess nearly specular positions. While the US (along with Taiwan, Japan, and South Korea) is pre-eminent in the global semiconductor supply chain, China has dominated rare earth elements mining and processing for years.

The tendency to “decouple” in both sectors over recent years leads us to think that if China succeeds in maintaining the current share of global rare earth elements supply and expand, as it plans to do, its capabilities in semiconductor production and refinement, it will garner huge influence in the future global economy.

The same applies to the US, which will reach even greater dominance on global technology if it succeeds in developing an REE self-sufficient supply chain and reclaiming, eventually, its dominant position of the past.

Bibliographical note and sources

–> Raimondi P.P., “The scramble for Africa’s Rare Earths: China is Not Alone”, ISPI, 7 june 2021.

–> Sullivan J., Deese B., “Executive order on America’s Supply Chains: A Year of Action and Progress”, The White House, 7 February 2022.

–> Statements and releases, “Fact Sheet: Securing a Made in America Supply Chain for Critical Minerals”, The White House.

–> Zhu C., Zhu W., Deaux J., “China Cements Rare Earths Dominance with New Global Giant”, Bloomberg News, 23 December 2021.

Various articles from Al Jazeera, Forbes and China Briefing are referenced in the text.

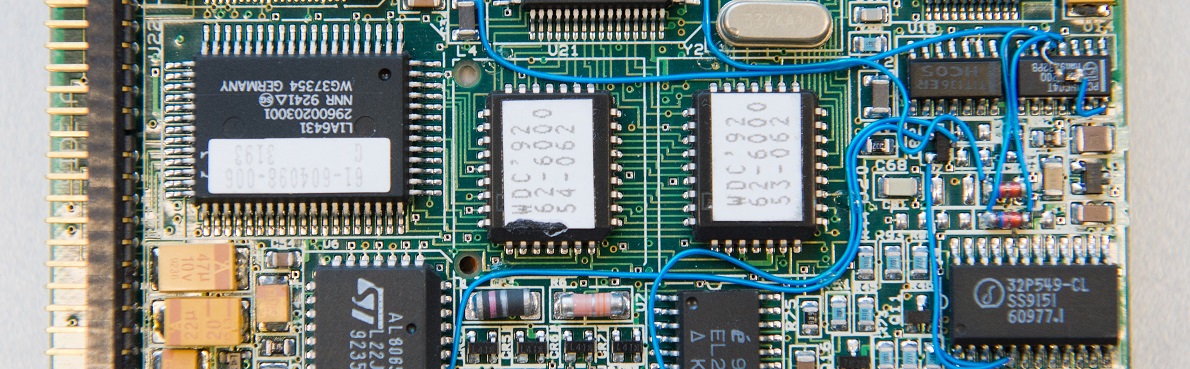

Cover Photo: Recycling and extraction of rare metals (Julian Stratenschulte/dpa Picture-Alliance via AFP)

Follow us on Facebook, Twitter and LinkedIn to see and interact with our latest contents.

If you like our analyses, events, publications and dossiers, sign up for our newsletter (twice a month) and consider supporting our work.